The most recent PBS data from Medicare Australia has confirmed that, when it comes to the 15 million Australians without a concession card, the scheme is transforming into a 'safety net' for high cost medicines.

The 1 October price cuts triggered another decline in the non-concessional General PBS category.

The first round of price cuts under Simplified Price Disclosure on 1 October triggered reductions to 442 forms and strengths of 82 drugs, ranging between 10 per cent and 62 per cent, delivering more than $400 million in annual savings.

Price cuts mean that more PBS-listed medicines are priced below the $36.90 General co-payment. Once below the co-payment, a prescription is effectively removed from the PBS because the consumer covers the entire cost.

Data from Medicare Australia shows that, in October, General patients paying the $36.90 co-payment comprised just 8 per cent of all processed PBS prescriptions, down from almost 10 per cent in October last year, and over 12 per cent ten years ago.

The fall has been even more stark in the General safety net category, under which patients qualify to pay the concessional $6 co-payment once their PBS prescription costs for the year exceed $1421.20.

In October, the General safety net made up just 2 per cent of all processed PBS prescriptions, down slightly on last year, but down from 5 per cent in 2007.

Yet, ironically, the General category share of PBS benefits paid continues to skyrocket.

In October, 25 per cent of all PBS benefits processed were for the General (ordinary) category, up from 15 per cent ten years ago.

The stuctural transformation in PBS spending for the non-concessional General category, away from relatively low cost high volume primary care drugs, to high cost low volume speciality drugs, is driven by the combined impact of patent expiries on some of the most commonly prescribed medicines and price disclosure.

Many of the medicines now priced below co-pay were high volume but relatively low priced, such as statins and anti-hypertensives. An increasing number of these lower priced medicines have effectively been removed from the PBS for non-concessional General patients, leaving relatively higher priced medicines.

The transformation is evident in the rapid growth in the number of under co-payment prescriptions, which now account for over one-quarter of all PBS prescriptions, up from 62 million to 72 million in 2013-14. This does not include the burgeoining market of non-PBS private prescriptions.

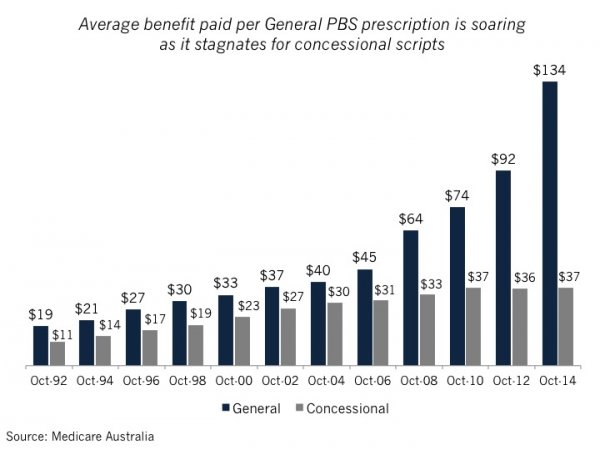

It is also evident in the soaring average benefit paid per General PBS prescription, which was almost $134 in October, up from $92 two years ago, and $64 in 2008.