Bayer, Pfizer, Bristol-Myers Squibb, Amgen and Biogen are amongst the winners in early 2015 according to market intelligence firm NostraData.

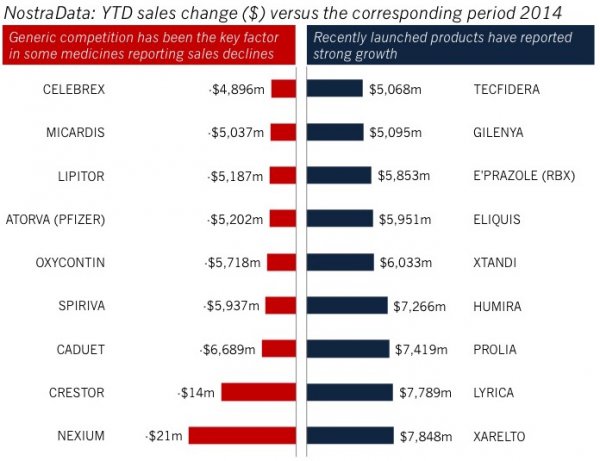

In their most recent report covering 2015 year-to-date (YTD), the company that collects prescription medicine data from over 3,000 community pharmacies shows Pfizer and Bristol-Myers Squibb's anticoagulant ELIQUIS (252 per cent), Biogen's oral Multiple Sclerosis therapy TECFIDERA (88 per cent), Bayer's anticoagulant XARELTO (68 per cent) and Amgen's PROLIA (67 per cent) for osteoporosis, leading the way with sales growth compared to the corresponding period in 2014.

ELIQUIS has reported YTD sales growth versus 2014 of $5.9 million, XARELTO $7.8 million, PROLIA $7.4 million and TECFIDERA $5 million.

In terms of total YTD sales, AbbVie's rheumatoid arthritis blockbuster HUMIRA is the market leader with $56.7 million, according to NostraData, followed by Novartis' GILENYA for Multiple Sclerosis with $34.2 million and Pfizer's LYRICA for neuropathic pain with $27.9 million.

In terms of products reporting the most significant sales decline for the first part 2015 versus 2014, the biggest factor according to NostraData is patent expiry and generic competition.

AstraZeneca's cholesterol-lowering CRESTOR and NEXIUM for reflux both reported significant declines following patent expiry, of 41 per cent and 40 per cent respectively.

Much of NEXIUM's decline is reflected in Ranbaxy's generic competitor reporting $5.8 million in YTD sales.

Pfizer was also heavily impacted by patent expiries.

CADUET was down 43 per cent, CELEBREX for arthritis was down 59 per cent, and cholesterol-lowering LIPITOR was down 45 per cent. Atorvastatin Pfizer, the company's own generic brand of LIPITOR, was down 56 per cent.

Mundipharma's OXYCONTIN, which is also subject to generic competition, was down 39 per cent.

NostraData's analysis also provides a more stable and consitent assessment of the PBS compared to monthly Medicare data, which shows significant month-on-month volatility.

In terms of growth, NostraData's Mike da Gama says while the PBS is reporting strong growth in terms of volume - 1.7 per cent year-to-date - value is down 3.8 per cent.

According to da Gama, 2015 is set to be the lowest claim year in the last 4 years.