It is virtually impossible to understate the extent of the structural transformation the PBS has gone through in recent years.

The structural transformation has created a completely different environment for negotiation of the 6th Community Pharmacy Agreement (Agreement), and any other reforms, compared to what was the case during negotiation of the current Agreement and the Memorandum of Understanding between Medicines Australia and the former government.

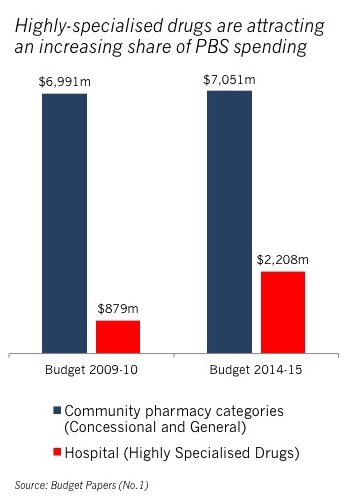

Since the 2009-10 Budget, PBS spending has undergone a significant shift, with spending on the community pharmacy-focussed 'Concessional and General' categories not growing at all, and declining in real terms, while the hospital-focussed Highly Specialised Drugs Program has grown dramatically.

This shift highlights the strategic challenge faced by community pharmacy in negotiation of the new Agreement.

That portion of their remuneration linked to the price of PBS medicines has been significantly 'shelled-out' by the impact of patent expiries and price cuts, which have also eroded revenue from trading terms.

Put simply, as the prices of PBS medicines plummet, many by more than 90 per cent, pharmacy remunersation falls.

A new analysis from market insights firm NostraData confirms the challenge confronting pharmacy.

NostraData captures every script from over 3,000 pharmacies nationwide. To maintain consistency, it classifies every PBS Approved Drug as PBS irrespective of whether there was a Government Claim or Private script attached to the dispensed item.

According to NostraData, while prescription volume is growing value is down.

"Growth in volume of sales continued in March, with the largest single-month gain in 15 months of 5.7%," it says. "This brings the YTD volume to 1.7% and the strongest quarter in volume terms for a couple of years."

However, it also says that year-to-date value is down 3.8 per cent.

According to NostraData's Mike da Gama, 2015 is set to be the lowest claim year in the last 4 years.

"This is in line with community pharmacy claims that the PBS growth is not driven by community pharmacy but by more expensive highly specialised drugs not commonly dispensed by community pharmacy," said da Gama.

Between the 2009-10 and 2014-15 Budgets, spending on the pharmacy-focussed categories has fallen from almost 90 per cent of total PBS expenditure to just 73 per cent.

In nominal terms, the categories attracted around $6.99 billion in PBS spending in 2009-10, based on the Budget papers. By 2014-15, this had grown by just $60 million ($7.05 billion).

At the same time, spending on the hospital-focussed Highly Specialised Drugs category has soared at an average annual rate of around 20 per cent - from just $879 million in 2009-10 to a forecast $2.2 billion in the 2014-15 Budget.

Much of this growth, which has been driven by the increasing number of high-cost targeted medicines, including biologics, has been 'hidden' by the declining pharmacy-focussed categories.

The growing Highly Specialised Drugs is likely to attract the attention of policy-makers, particularly with the emergence of biosimilars.